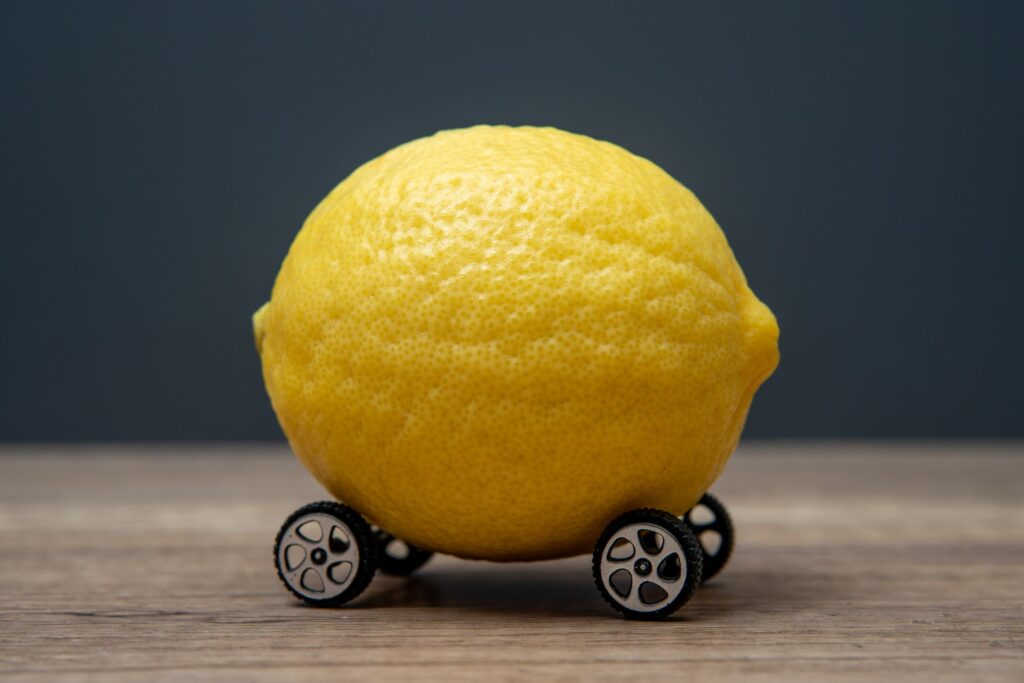

When you purchase a vehicle that turns out to be defective, you’re already dealing with frustration and inconvenience. But what happens when that lemon comes with another financial burden: negative equity? Understanding how these two issues intersect is crucial for protecting your rights and minimizing your losses.

What Is Negative Equity?

Negative equity, often called being “upside down” on a loan, occurs when you owe more on your auto loan than the vehicle is worth. This commonly happens because vehicles depreciate quickly, especially in the first few years of ownership. If you made a small down payment, rolled negative equity from a previous vehicle into your new loan, or chose an extended loan term, you’re particularly vulnerable to this situation.

Lemon Law Basics

Lemon laws exist in every state to protect consumers who purchase defective vehicles. While specifics vary by jurisdiction, these laws generally require manufacturers to repair, replace, or refund vehicles with substantial defects that impair safety, value, or use. To qualify, the defect typically must persist after a reasonable number of repair attempts or cause the vehicle to be out of service for an extended period during the warranty coverage.

The Intersection Problem

Here’s where things get complicated. When you prevail in a lemon law claim, the manufacturer will compensate you, but this compensation may not fully account for the amount owed on the vehicle. For example, lemon law remedies typically include either a replacement vehicle or a refund that covers the purchase price minus a usage deduction for the miles you drove.

However, this refund typically goes toward paying off your existing loan. If you’re upside down on that loan, you could receive your vehicle replacement or buyback and still owe thousands of dollars to your lender for a car you no longer own. This has the potential to create a financial trap where you’re forced to continue paying for a defective vehicle you’ve already returned.

Protecting Yourself

The good news is that some lemon law statutes do address negative equity concerns. Certain states require manufacturers to pay off the entire loan balance, including negative equity, as part of the settlement. Other states allow you to recover incidental costs that may include some financial losses related to your loan situation.

When pursuing a lemon law claim with negative equity, documentation is essential. Keep records of all repair attempts, communications with the dealer and manufacturer, loan statements, and any expenses incurred due to the defect. Consult with a lemon law attorney who can navigate your state’s specific provisions and potentially negotiate a settlement that addresses your negative equity.

Additionally, consider gap insurance when purchasing vehicles. While it won’t help with lemon law cases specifically, it protects you if your vehicle is totaled or stolen while you have negative equity.

Moving Forward

Dealing with both a lemon vehicle and negative equity is undoubtedly stressful, but knowing your rights empowers you to take action. Don’t let the complexity of negative equity discourage you from pursuing a legitimate lemon law claim. With proper legal guidance from a lemon law attorney with Bad Vehicle, you will be empowered to pursue fair compensation and avoid being financially responsible for a defective vehicle long after it’s gone. Schedule your free lemon law case evaluation today